LOYALTY: Payment services let small business fly Business Class

The points economy is now an AU$5 billion industry. Gaming the system is the way to go to allow sole traders and SME (Small to Medium Enterprise) owners to turn their bills into Business Class flights. The way to achieve this is by making expenses like rent, wages, BAS payments and even tax, earn points that can be redeemed for international flights.

It’s long been true that loyalty schemes are more valuable to airlines than actually flying. But now, through new payment platforms, even small business owners can take advantage of those schemes.

What follows here are descriptions and observations of this field, and in no way should be taken as business, personal or financial advice. I’m not qualified to give any of that.

![Massive new overhead luggage bins allow up to 50% more on board storage, but Virgin won't be adjusting allowance. [Virgin Australia]](https://www.2paxfly.com/wp-content/uploads/2023/07/Virgin-Australia-737-8-interior2.jpg)

Turning bills into business class

If you can route your spending through the right payment platform, then the earned points can be turned into flights fast.

Services like Pay.com.au, RewardPay, B2B Pay and Yak Pay let SMEs pay almost any bill, rent, suppliers, wages, Australian Taxation Office (ATO) payments, with a rewards-earning card. You will be charged a fee by the platform, but in exchange, you earn points that can outvalue that cost by two or three times.

If you are a very small business owner or sole trader, the gain might seem small. But, if you are an average SME owner, then you might, on average, be routing AU$4 to $5 million of business expenses through one of these platforms. Earning two or three times what you spend then makes your problem not how to earn the points, but how to spend them.

Your problem will be finding enough desirable premium cabin fares to redeem those points.

![Qantas First Lounge, Sydney [Schuetz/2PAXfly]](https://www.2paxfly.com/wp-content/uploads/2023/08/Qantas-Melbourne-First-Lounge-IMG_4085.jpg)

You have to pay to earn

Remember, though, that this isn’t actually free money. If you pay a AU$20,000 bill through Pay.com.au, for example, it might cost you AU$270 after tax. However, the value of the points earned could be closer to AU$700.

Card payments typically come with lengthy interest-free periods (51–55 days on some cards), giving SMEs breathing room while they wait for clients to pay.

If you’re a business owner caught between invoices and cash flow cycles, earning enough points for a business-class flight while smoothing out your books may be an attractive option.

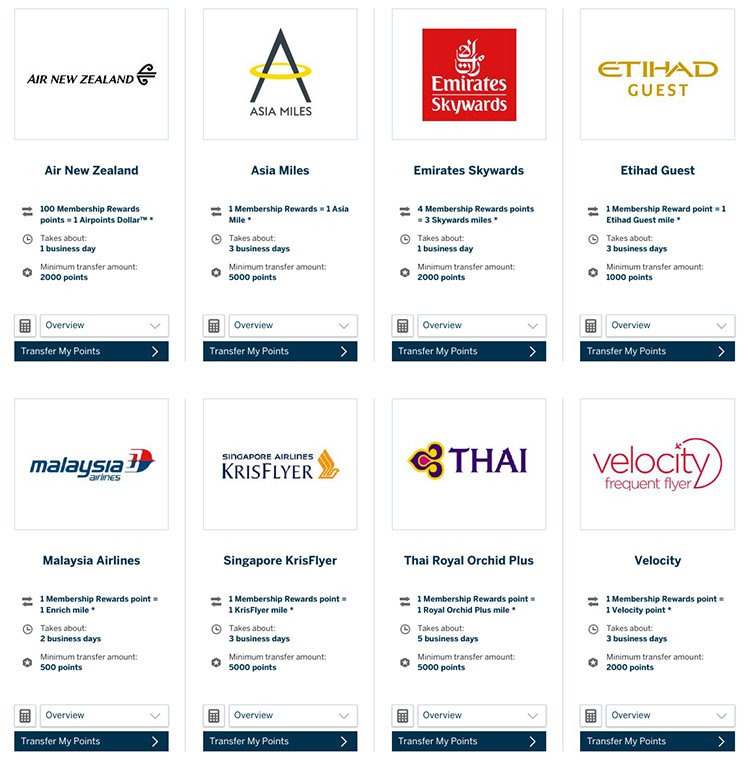

More airline partners than Amex

Your earning and redemption options differ on each platform, but some are even better than credit cards, better than even on American Express.

Pay.com.au, for example, now has more airline partners than American Express. Their roster includes: British Airways, Cathay Pacific, Japan Airlines, Qantas, Singapore Airlines and Virgin Australia amongst others.

RewardPay focuses on Qantas, even giving promo rates of say 30% bonus Qantas Points on spending.

Airlines are more trusted than their loyalty programs

Research shows people still recommend airlines to their friends, but increasingly don’t recommend the airline’s loyalty program. Why? Because the game keeps changing.

During COVID, when few were flying, points schemes held their value, and later, airlines boosted earn rates as a lure to customers. Of course, the obvious happened, redemptions surged, and airlines responded by devaluing points. Qantas, Virgin, and Singapore Airlines KrisFlyer programs are some examples.

The Reserve Bank of Australia has announced a crackdown on interchange fees and surcharges in 2026. When that happens, banks are likely to pay airlines less for points. Airlines will almost certainly pass that devaluation straight back to customers.

Although these payment platforms that offer points look attractive, if you play the points game, expect turbulence.

Help to game the system

As the points economy grows, the points-optimisation industry is growing right alongside it. When investors are valuing a platform at, say, AU$600 million, as in Pay.com.au, you get advisory services like Pontify, which can help you earn and redeem those points.

Earning points may be a business necessity, but redeeming them for maximum value is more of an art form.

Frequent flyer programs are now worth more than airlines

Although we all may value airlines for their flight experiences, cabins and aircraft, that is no longer what makes them money. Points programs are now more valuable than the entire airline they depend on.

The tail is not just wagging the dog, the tail now owns the dog, the kennel, and the frequent-flyer lounge next door.

![Virgin Australia new interior for the Boeing 737-8 and their new MAX jets [Virgin Australia]](https://www.2paxfly.com/wp-content/uploads/2022/12/Virgin-Australia-va-737-new-interior-2021-1196x675.jpg)

2PAXfly Takeout

The points economy has been a niche hobby for years. Today it’s seen as a multi-billion-dollar ecosystem, a financial product, a cashflow tool, a reward system and business strategy, and a psychological flytrap for points-hungry Australians.

For SME owners, these platforms seem to make economic sense, especially when the points are worth 2–3× the fee.

But let’s be clear, this game works best for a small segment of high-spend customers. If you are a smaller fish, your retail payments are likely subsidising the earnings of others.

If you’re going to play this game at any scale, then seek some sound financial advice, and not the musings of an inexpert airline blogger like me. However, you could start with the basics: your earn rate, points redemption value, fees you will pay, and how your plans will be affected by any devaluation. Because, as day follows night, that will come.

This is clearly just a futile and deceptive attempt to Inflate the perceived market value of Pay.com.au for a potential private/public sale? Nice to know you’re all connected. [Edit of trolling comment]

Hi Li(n)dsay/Bert B,

Thanks for your comment. The assumption you make are incorrect. I have no connection or interest in any of the four payment platforms named in the post. The trolling aspect of your comment has been removed.