ACCC: It’s official – Australia’s domestic airline industry lacks effective competition

Just a warning here that this is an industry piece, that may not have the charmingly amusing quality of my normal writing. However, there is an underlying sense of outrage, that you might share, or at least find engaging in a schadenfreude kind of way.

Content of this Post:

Introduction

The Australian Competition and Consumer Commission (ACCC) has been running a project over the last few years monitoring the competitive behaviour of the Australian airline industry. They just brought down their official report.

“Domestic aviation is one of the most concentrated industries in Australia, barring only natural monopolies such as electricity grids and rail networks. Without a real threat of losing passengers to other airlines, the Qantas and Virgin Australia airline groups have had less incentive to offer attractive airfares, develop more direct routes, operate more reliable services, and invest in systems to provide high levels of customer service.”

ACCC Chair Gina Cass-Gottlieb

Lack of effective competition

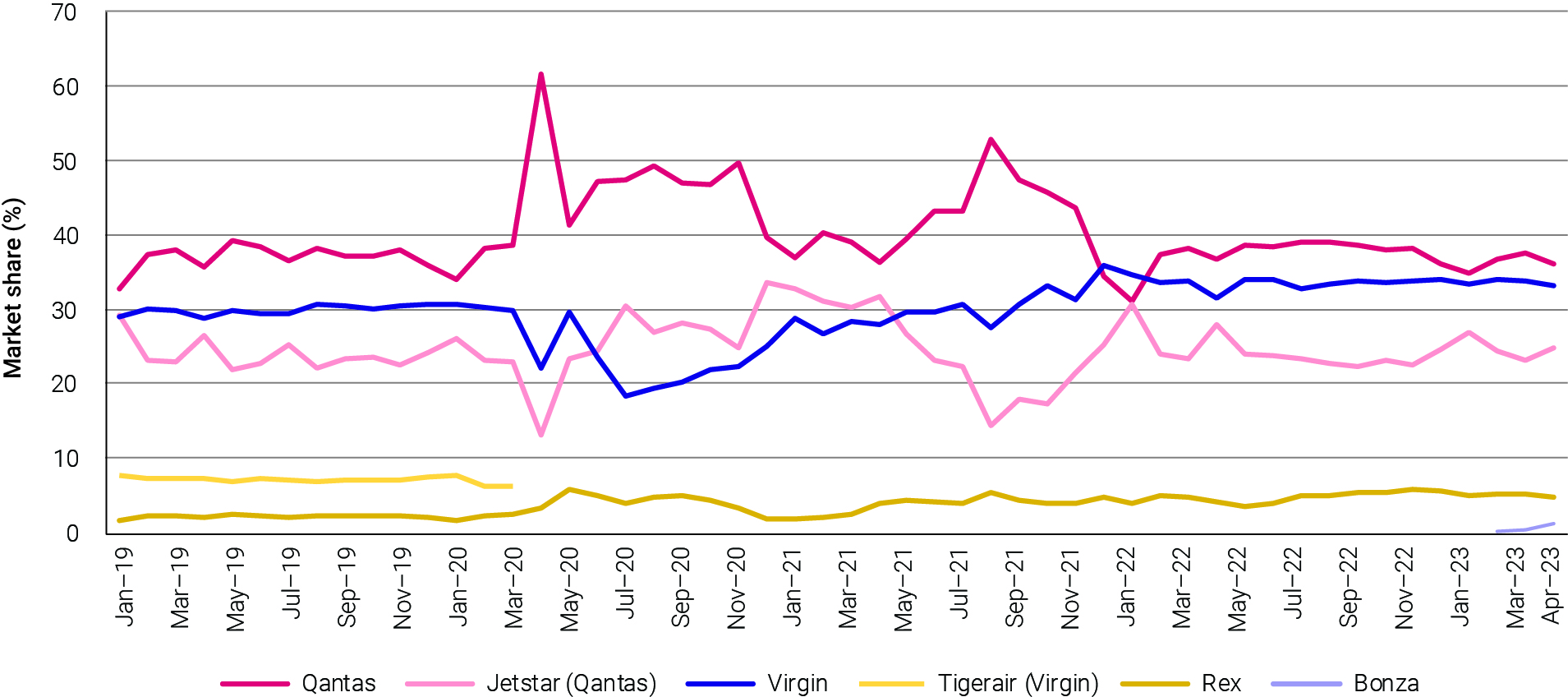

And the report concludes that Australia has been suffering from a lack of effective domestic airline competition for decades! Even with the advent of the new tourist airline Bonza, and the expansion of REX airlines from regional routes to inter-capital city routes does not currently up the competitive game. They jointly command about 6% (measured in April 2023). In the same month, Qantas and Virgin Australia had a whopping 90% share of the domestic market.

“Rex’s expansion onto major intercity routes and Bonza’s launch have been positive developments for competition, but their share of the market is small and there are barriers to growth,” Ms Cass-Gottlieb said.

ACCC Chair Gina Cass-Gottlieb

Domestic traffic, still less than pre-pandemic. Public becoming price sensitive.

The ACCC figures show that domestic airline passenger traffic is still below pre-pandemic levels. Comparing April 2023, when 4.6 million people took a doestic flight out of 6 million available seats, that is still only 92-93% of passenger numbers in April 2019. The ACCC has chosen April a a comparison, as it is a recent date, and usually a period of high leisure trafic due to Easter school hioidays. Effectively passenger numbers this easter were not as many as expected. The ACCC thinks that all that pentup post pandemic demand is probably beginning to ease. Contributing to that might be some growing price sensitivity.

“Consumers appear to have become more price-sensitive as cost-of-living pressures have increased.”

ACCC Chair Gina Cass-Gottlieb

Airline passenger market shares across all domestic routes – January 2019 to April 2023

Lower fares -just the start

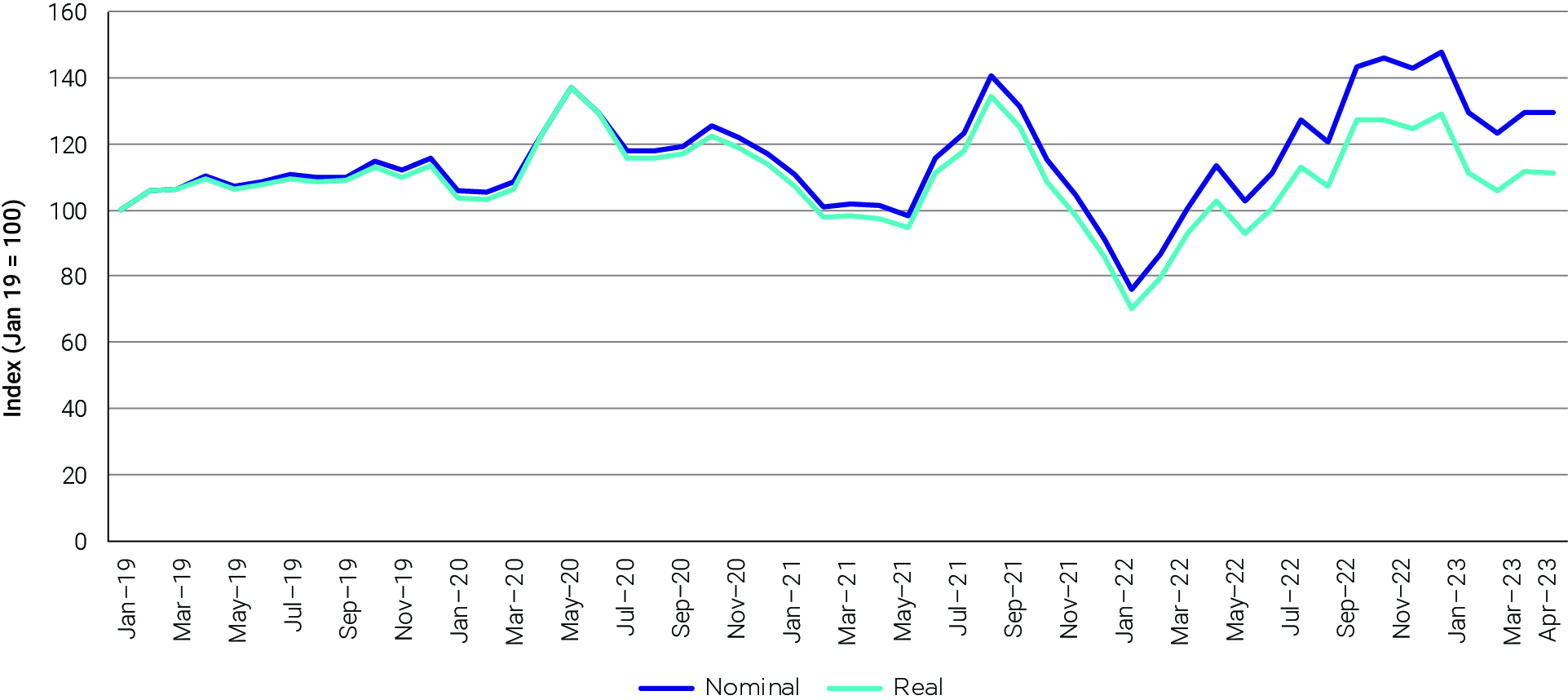

Airfares are cheaper than they were, although still higher than pre-pandemic. The ACCC analysis indicates that discount fares have fallen by 14% in the period February to May 2023. Average fare across all fare types, or average revenue per passenger is declining, as is the price of jet fuel, which has nearly harved since the peak in the middle of 2022.

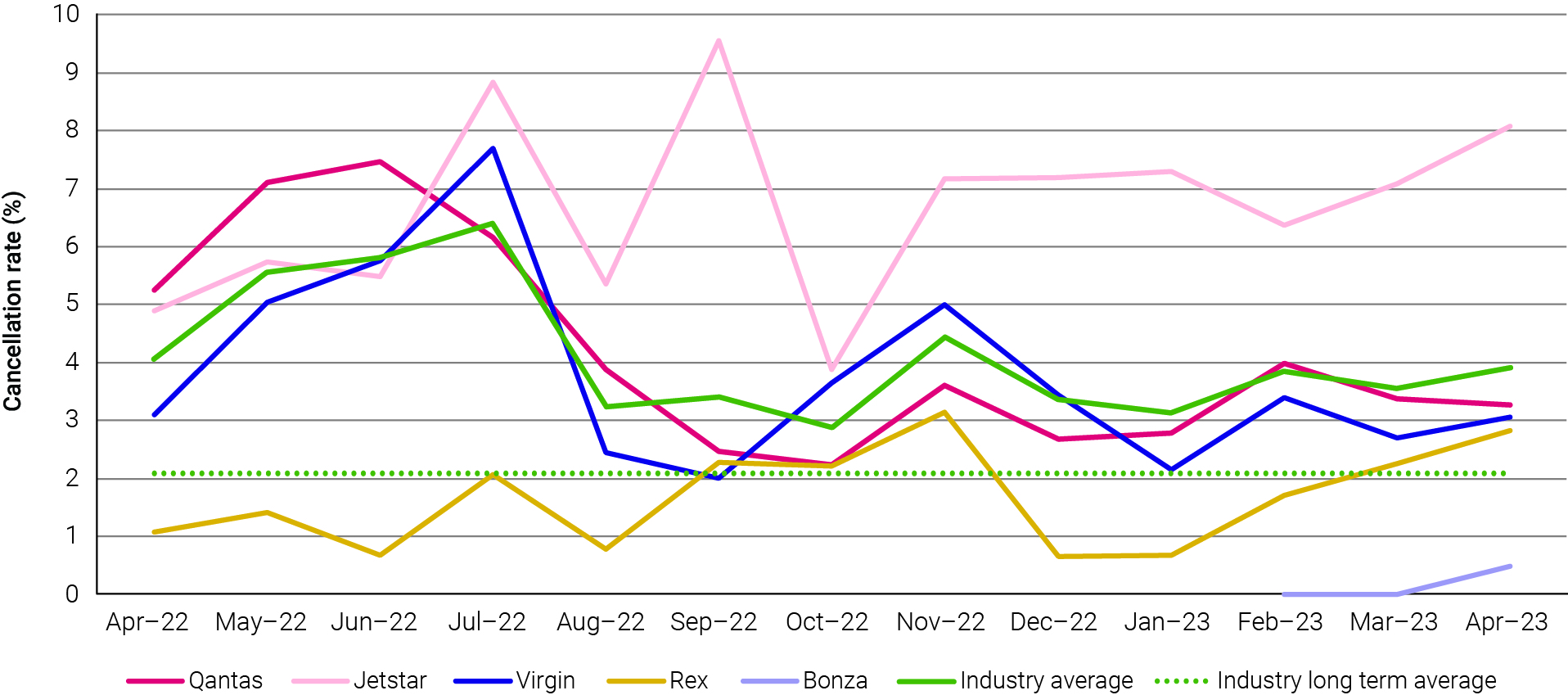

Airline cancellation rates – April 2022 to April 2023

Flight Cancellations and not so much bsiness flying

This is interesting. The overal average rate of flight cancellation is 2.1%. In April this year it averaged 3.9%, higher than in January. On time arrival is not good either with over 30% of all domestic flights arriving more than 15 minutes late, higher than the average of 18.5%.

Even more interesting is some perdeived change in busines treavelling practices, which may be indicative of some structural change in the industry, because business is continuing to use online technology for meetings instead of sending peope to airports.

Index of average fare revenue per passenger across all routes – January 2019 to April 2023

Jetstar doing really bad

The ACCC is critical of Jetstar’s performance, noting that its cancellation rates in April was over 8%, and that in March it was more than twice the industry average

Structural reform – slots at Sydney Airport

The report advocates changing the way take-off and landing slots are allocated at Sydney Airport as the quickest and best way to increase competition in the domestic sector.

“Access to peak time slots at Sydney Airport is critical for new and expanding airlines seeking to build an intercity network. Without legislative reform to the airport’s demand management scheme there will not be any material improvement in domestic airline competition in Australia in the foreseeable future.”

ACCC Chair Gina Cass-Gottlieb

Take that Qantas and Virgin Australia!

Consumer law reform

Declines in customer service have also been noted by the ACCC the massive increase in complaints may have contributed to that. The ACCC thinks it’s time for the government to step in, and legislate a proper dispute resolution body to replace the airline-run one.

…strongly advocated for reform to the consumer guarantees under the Australian Consumer Law, to make it illegal for businesses to fail to provide a remedy for consumer guarantees failures.

ACCC Media Release

“While our airline monitoring direction is ending, we’ll continue to watch for anti-competitive behaviour and unfair business practices in the airline industry. If we see evidence of this occurring, we will use our full range of enforcement powers to achieve compliance with the law.”

ACCC Chair Gina Cass-Gottlieb

2PAXfly Takeout

The ACCC has now completed its three-year-long monitoring of the airline industry, at the direction of the previous conservative government’s treasurer. It has issued 12 reports and will continue to observe.

I think this report provides some food for thought for Qantas shareholders, and for those contemplating buying into the Virgin Australia IPO rumoured to be occurring in the second half of 2022. The ACCC is saying to the government that they need to sort out a few things legislatively to unblock the competition pipes, and hand some more guarantees to the public on the consumer protection front. What’s more, they have a can-do type of government that is likely to be willing to take action.

Although this report is to do with domestic flying, it should be a warning to Qantas, that regulators may not be so willing to block other competitors. Think Qatar Airlines that is currently seeking to double its international flights to Australia.

What did you say?