CREDIT CARDS: Reward Point perks could be affected by bank reforms

Frequent flyer? Credit card points hunter? Lounge lover with a taste for luxury using credit card points? You’re about to get a little win — and maybe a little pain — thanks to changes from the Reserve Bank of Australia (RBA).

In a move designed to eliminate hidden costs and benefit all consumers using credit and debit cards, the RBA will ban retailers from charging separate credit or debit card fees at the checkout by July 2026.

At the same time, it’s cutting the interchange fees that banks receive from merchants when you pay with a card. While that’s good news for transparency and pricing, it could spell trouble ahead for points collectors.

Transparent fares and fees

The good news first: the days of paying a $10 card fee on a $39 airfare are numbered. Budget airlines, hotels, restaurants and anyone who slaps on a card surcharge will soon have to stop. Under the RBA’s plan, those charges will need to be absorbed into the headline price. No more shocks at check-out

So when you book that cheap fare on Jetstar or another airline, you’ll know exactly what you’re paying upfront. No checkout surprises. No hidden card penalties.

It’s a win for transparency and a welcome blow to the worst of ‘drip pricing’ — the practice of advertising a price and gradually adding other essential charges as you approach checkout.

Credit card rewards could take a hit

Now the less exciting part, especially if you’ve built your points stash by putting every tap-and-go transaction on a high-earning rewards card.

According to banks and financial commentators speaking to the Australian Financial Review (AFR), the RBA’s plan to cut interchange fees (the small cut banks get from each credit card transaction) means rewards programs will become more expensive to run — and something will have to give.

That could mean one or all of the following:

- Lower points earn rates per dollar spent

- Reduced bonus points offers on sign-up

- Higher annual fees

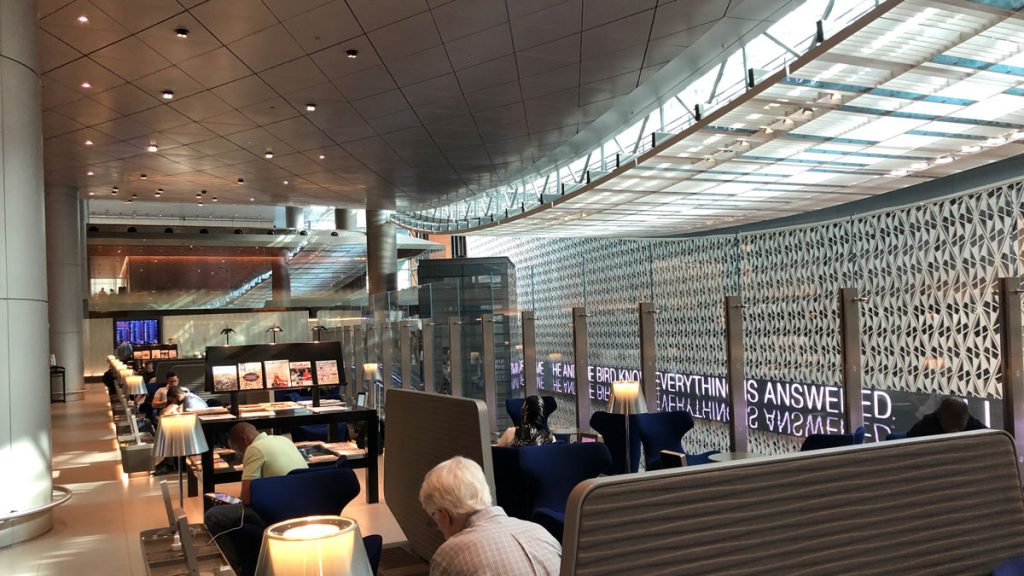

- Cutbacks on benefits like lounge passes or travel insurance

It’s already happened before. In 2017, when interchange fees were capped, banks slashed rewards points and restructured benefits.

Expect similar changes again, particularly on premium cards like American Express Platinum, Qantas Premier Platinum, and Velocity High Flyer.

Many of those cards have already suffered diminishing benefits and increasing fees. It’s probably worth reviewing your credit card strategy in light of these imminent changes.

What frequent flyers should do now

If you’re chasing elite status, upgrades or a dream redemption flight, now’s the time to act. Take advantage of current credit card sign-up bonuses, and maximise any offers that are still generous before they’re watered down. That means act now before the implementation date of July 2026. No need to rush. You have a year.

Here are some things to consider. Review your card mix, and prioritise those that have fixed value travel redemptions. If you can take advantage of any transfer bonuses, then now is the time to do it. As always, do’ bank those reward points for too long. Over time, their value universally diminishes, so spend as soon as you can on flights and hotel redemptions that give you the best value.

July 2026 might feel like a long way off, but changes to card perks and point structures will likely start earlier as banks pre-empt the shift.

Merchants may adjust prices

Because merchants will lose the surcharge revenue they currently enjoy, but still have to cover transaction costs, they will likely raise prices to compensate. The upside is that everything will be included in the advertised price. No surprises. No mental maths at the till.

That will make it easier to compare flights, fares and hotel rates across platforms and providers. And for those who don’t use points-earning cards, it levels the playing field.

What this means for premium cardholders

If you’re holding a top-tier card with all the trimmings. You know, lounge access, hotel upgrades, fast-tracked status — now’s the time to check the fine print.

Perks are likely to be restructured. That $450 annual fee might no longer deliver the value it once did. And don’t be surprised if sign-up bonuses shrink or if the minimum spend thresholds increase.

Be strategic: look for value, not just status, and consider whether the benefits still outweigh the costs.

2PAXfly Takeout

For price-sensitive travellers and those tired of card fees, this is a significant win. For frequent flyers and points devotees, it’s a nudge to reassess strategy, and to act while the perks are still flowing. In the longer term, it means for Australia the credit card points earning game is likely to be less lucrative for devotees.

Interchange fee changes are expected to take effect by December 2025. The card surcharge ban will take effect by July 2026.

If you’re thinking of applying for a new card or booking a big redemption, don’t wait. Now’s the time to stockpile and redeem while the programs are still rewarding.

What did you say?